On Friday 27 October, IAG (LSE:IAG) shares dipped slightly after the European aviation giant registered a record-breaking third-quarter. Operating profit came in at €1.75bn, a substantial increase from the €1.22bn reported in the same period last year.

While we may expect to see the share price surge after such a performance, it worth highlighting that some of the earnings would have already been priced in. The market also likely reacted negatively to comments about “wider macroeconomic and geopolitical uncertainties” that could negative impact Q4 and FY2024.

A shrewd investment?

Like many investors, two years ago I piled into aviation stocks thinking they were on their way up. Of course, things didn’t work out quite that way. One reason was Russia’s war in Ukraine, which sent oil and fuel prices soaring. It also meant Russian airspace, and there’s a lot of it, was out of bounds for most Western airlines.

So, if I’d bought IAG shares two years ago, today I’d have 10.7% less than my initial investments. My £1,000 would be worth £893 today. Obviously, that’s a pretty poor return, especially when there’s no dividend involved.

Price targets

Price targets can be a good place to start if you’re looking to reinforce your conviction in a stock. That’s certainly what I do.

Interestingly, IAG has one of the largest disparities between its share price and the targets set by analysts.

At the time of writing, IAG shares trade hands for £1.41, but the average price target is currently £2.40. That’s a pretty mammoth difference.

Sometimes the disparity relates to short positions in the market, or maybe its just near-term concerns that keep holding the stock back.

We can also observe that analysts are very upbeat on the British Airways owner. The stock has 10 ‘buy’ ratings, one ‘outperform’ rating, four ‘holds’ and one ‘underperform’.

Tailwinds and headwinds

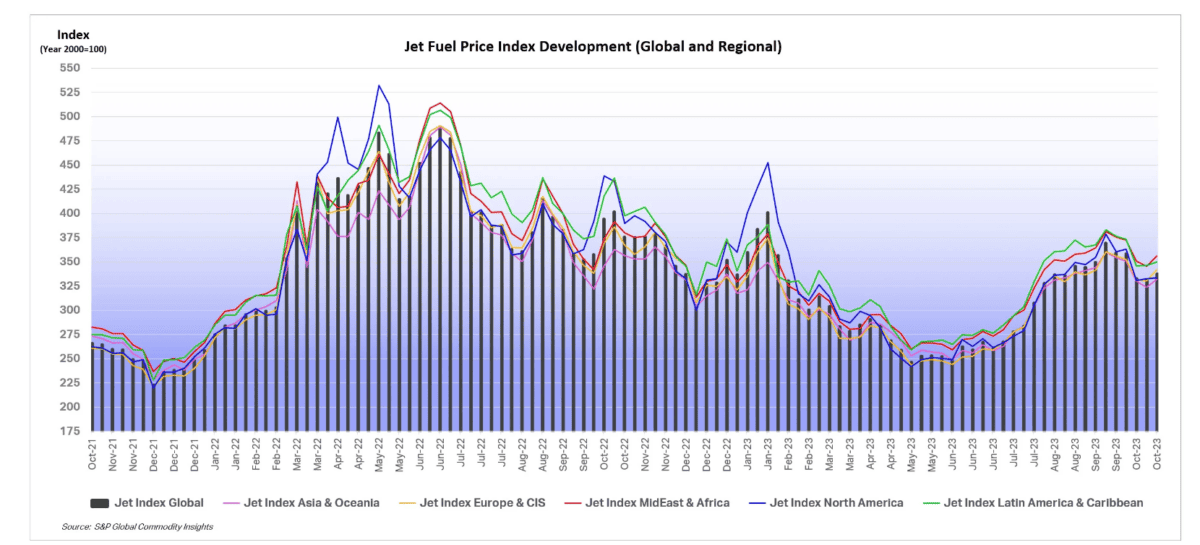

The main headwind we’re seeing at this moment is rising fuel prices. The volatility created by the conflict between Israel and Gaza has pushed oil prices up significantly, and an escalation of the war could be catastrophic given the proportion of global oil production in the region. This is arguably the biggest downward pressure on the stock right now.

However, like all airlines, IAG has a hedging strategy to protect it against near-term volatility in fuel prices. The airline has hedged 65% in Q4 2023, 58% in Q1 2024, 49% in Q2 2024, and 39% in Q3 2024.

Despite fuel price concerns, the IAG investment hypothesis remains strong. Firstly, debt is falling. The airlines operator reported a €2.4bn reduction in gross debt in Q3, bringing the total to €17.2bn as of 30 September.

Secondly, capacity is increasing and demand is robust. IAG noted a year-on-year capacity expansion of 17.9% in Q3, reaching 95.6% of its 2019 pre-pandemic capacity level.

And finally, the long-term demand forecast is incredibly positive. Aircraft manufacturers are anticipating the need for 42,000 new planes over the next two decades as demand surges, partially driven by a growing global middle class.

If I had spare capital, I’d top up my holdings.